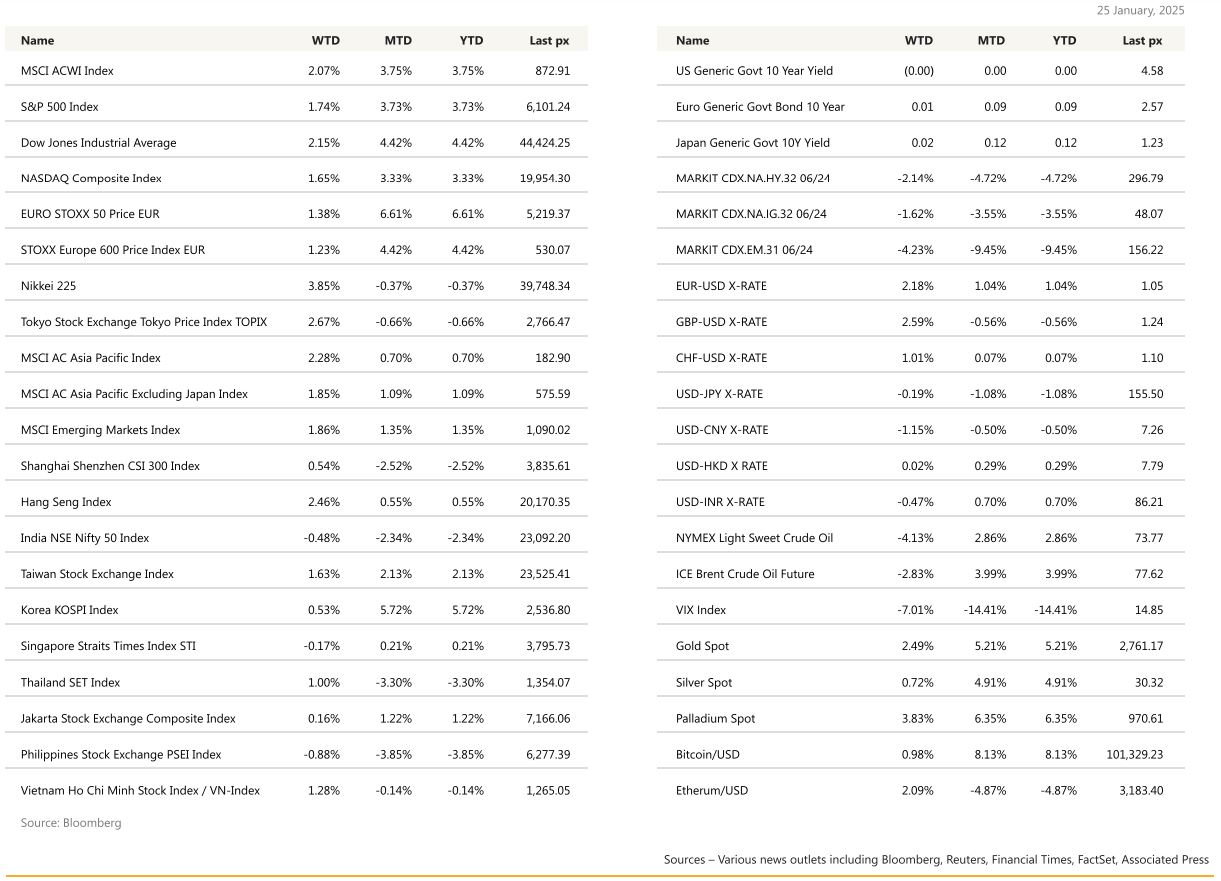

KEY MARKET MOVES

MACRO OVERVIEW

US

US markets ended the week on a positive note, with the S&P500 up 1.74%.

Last Wednesday, two days after President Trump inauguration as the new US president, he said, “If we don’t make a “deal”, and soon, I have no other choice but to put high level of Taxes, Tariffs, and sanctions on anything being sold by Russia to the United States, and various other participating countries. Let’s get this war, which never would have started if I were President, over with! We can do it the easy way, or the hard way, and the easy way is always better.”

A lot of announcements last Thursday by President Trump and his new administration:

- The US military has moved its Typhon missiles launchers from an airfield in the Philippine to another location on the island of Luzon, in what expert describe as signaling “greater tension” between Washington and Beijing.

- Trump ask Saudi Arabia and OPEC nations to increase oil production to lower prices and put pressure on Russia to end the war in Ukraine.

- Trump reiterated his threat to use tariffs on European export to the US.

- Trump also said he will demand an immediate drop in interest rates. The FED independence will again be in the spotlight.

Last Friday, President Trump expressed a reluctance to impose tariffs on China during a television interview, suggesting a trade war between the world’s largest economies could be avoided.

In terms of data, the flash January PMI composite came in at 52.4, marking a nine-month low and falling short of expectations for 55.2. The Manufacturing PMI was 50.1, beating the consensus of 49.8, signalling growth for the first time in six months. However, the Services PMI dropped to 52.8, its weakest since April 2024, and below the expected 55.6. The report highlighted rising inflationary pressures, with both input costs and selling prices increasing at the fastest pace in four months. Employment rose in January at the fastest rate in two and a half years. Meanwhile, the final January UMich consumer sentiment index fell for the first time in six months, to 71.1, below the expected 73.2. One-year inflation expectations rose from 2.8% in December to 3.3%, the highest since May 2024, while long-run inflation expectations increased from 3.0% to 3.2%.

The Current Economic Conditions Index fell to 74.0 from 75.1, and the Index of Consumer Expectations dropped to 69.3 from 73.3. Finally, December existing home sales were 4.240 million, surpassing the consensus of 4.200 million and November’s 4.150 million. Looking at the details, however, it shows how the numbers have ventured into very polarized territory since the US election. Democrats and Republicans having very different views on the outlook. On the preliminary estimate for January, for example, Republican supporters suggested 1-year inflation would be 0.1% whereas Democrat supporters expected 4.2%.

Initial claims for unemployment benefits were 223K, slightly above the consensus of 219K and up from the prior week’s 217K. This marked the highest level since mid-December, with the fourweek moving average increasing to 213,500. Continuing claims were 1.899m, higher than the consensus of 1.868m and the previous week’s revised 1.853m.

Earnings season has been strong so far. Of the 16% of S&P 500 companies having reported fourth-quarter results, 80% have posted a positive earnings per share surprise and 62% have reported a positive revenue surprise.

Key data this week includes the January PMI Composite, December existing home sales, and final January consumer sentiment. This week’s highlights include the January FOMC meeting on Wednesday, consensus expect no change (i.e. Fed funds remaining at 4.50% for the upper bound), Q4 preliminary GDP on Thursday, and December PCE data on Friday. Four out of seven companies in the ‘Magnificent 7’ are set to post quarterly earnings in the coming days. Meta Platforms, Microsoft and Tesla each report on Wednesday, and Apple will release results on Thursday.

Europe

European equity markets closed the week higher with the Eurostoxx 600 up 1.23%. The HCOB Eurozone preliminary Composite PMI for January rose to 50.2, above the expected 49.7, surpassing analyst forecasts. The absence of immediate tariffs from Trump may have contributed positively. The manufacturing PMI came in at 46.1, better than the expected 45.4, though it remained in its 31st month of contraction. Services posted their second month of expansion but fell short of estimates, with a reading of 51.4 versus the expected 51.5. Employment showed near stabilization, with job gains in the service sector nearly offsetting losses in manufacturing. For Germany, the PMI indicated the economy stabilized at 50.1, ending a six-month contraction, thanks to growth in the services sector (52.5), even though manufacturing continued to contract (44.1). Meanwhile, France’s private sector faced ongoing challenges, with its Composite PMI at 48.3. Services continued to shrink at 48.9, while manufacturing showed a slight improvement at 45.3, in contrast to the broader positive signs in the EU.

While economists still expect four quarter-point rate cuts, opinions are divided on the timing and extent of those reductions. The current consensus favors cuts in January and March, but uncertainty grows starting in April. Persistent services inflation, a strong labor market, and potential trade war risks have shifted analysts’ views, with most now believing the risk of overshooting the 2% inflation target outweighs the risk of falling short. Around 71% of economists expect the neutral interest rate to be between 2% and 2.25%, with most anticipating this level by June. US policy and potential economic disruptions remain significant risks. This analysis contrasts with the views of traders and investment banks. Traders are betting on a 50bps rate move this year, while most investment banks see room for more ECB easing than the markets are currently pricing in. Barclays recently suggested 150bps of easing in 2025, citing the need to balance inflation control with growth concerns. Former ECB member Angeloni recommended that the ECB adopt a more forwardlooking approach, clarifying its stance on the “new normal” interest rate level, which might involve reviving inflation forecasting models and considering a stronger policy response to deviations from the 2% target.

The UK PMI data showed more positive signs, with the composite reading reaching a three-month high of 50.9, beating the consensus of 50.1 and slightly down from the previous 50.4. This was driven by an acceleration in the services sector, which rose to 51.2, surpassing the forecast of 50.8 and the prior 51.1. The manufacturing slowdown also showed signs of stabilizing, with a three-month high of 48.2, above the consensus of 47.0 and matching the previous reading. However, despite the improvement in the services sector, the overall tone of the survey remained fairly downbeat. Additionally, there were signs of inflationary pressures, with average prices charged increasing at the fastest pace in 18 months. The GfK’s UK consumer confidence measure fell to its lowest level since December 2023, dropping to -22 from a consensus of -18 and the prior -17. All of the GfK indicators contributing to the headline index declined, with the biggest drop seen in the economic outlook.

This week, we will see the European Commission’s Economic Sentiment Indicator (ESI), the GDP figures and unemployment rate and the ECB rate decision on Thursday. We will also see the 3-year CPI Expectations in the EU on Friday.

Asia

Global markets staged a rebound last week, calming immediate fears of a global trade war as President Donald Trump refrained from placing immediate import levies on goods from key trading partners such as Mexico, Canada, and China. MSCI Asia was up 2.28%, led by Hang Seng and Taiwan up by 2.46% and 1.63% respectively. Nikkei was the best performer in Asia up 3.85% post BOJs first hike in 2025.

Asian markets opened the week on a positive note, but soon weakened this morning. Investors remain wary following Trump’s decision to impose tariffs and sanctions on Colombia, highlighting the unpredictable nature of his trade policies and their potential to disrupt global markets. DeepSeek, a Chinese app, has become one of the most downloaded on Apple’s App Store, signalling the growing influence of Chinese innovation in the tech and AI space. This development could intensify competition for major players like Tencent and Alibaba, while also reshaping market dynamics.

Meanwhile, U.S. tech giants are set to release earnings this week, which could weigh on market sentiment as analysts factor in the impact of emerging AI advancements like DeepSeek. The interplay between China’s tech progress and U.S. corporate performance will be closely watched, with potential implications for both market valuations and global tech leadership.

Japanese investors have offloaded Eurozone government debt at an unprecedented pace, with net sales reaching €41 billion in the six months to November, according to data from Japan’s finance ministry and the Bank of Japan. This marks the fastest sell-off in more than a decade, driven by the prospect of rising bond yields in Japan and heightened political uncertainty in Europe.

The collapse of Germany’s ruling coalition, with elections imminent, and France operating under an emergency budget law amid political turmoil have further fueled the exodus. Analysts note that the pullback by Japanese investors is adding upward pressure on Eurozone bond yields, which have already been climbing since the European Central Bank began reducing its balance sheet following its expansive emergency bond-buying program during the pandemic.

In Asia, Lunar New Year holidays will see quiet trading. Hong Kong will be closed 29th Jan through 31 Jan.

China’s central bank has pumped a record amount of short-term funds into the financial system this week in an effort to pre-empt the cash crunch that usually accompanies the lunar new year holiday. Aimed at smoothing seasonal turbulence, the total cash injection of Rmb2.2tn ($300bn) through the 14-day reserve repo — a short-term liquidity tool — comes as millions of residents prepare to travel home, settle tax bills and hand out cash-filled red envelopes.

Here’s what we’ll be watching:

- Monday, Jan. 27: China manufacturing PMI, nonmanufacturing PMI and industrial profits

- Tuesday, Jan. 28: China Lunar New Year (Jan. 28 through Feb. 4)

- Wednesday, Jan. 29: Australia CPI, BOJ minutes (for Dec. 18-19 meeting)

- Friday, Jan. 31: Japan jobless rate, retail sales, industrial production and Tokyo CPI, Samsung earnings

GeoPolitics

US – China: A Chinese start-up called DeepSeek astonished the international tech community with its latest open-source artificial intelligence model. DeepSeek-V3 delivers a performance comparable to that of better-funded US rivals such as OpenAI. This week it impressed once again with R1, its foray into AI reasoning. Since the middle of last year, Chinese tech companies such as Alibaba, Tencent, ByteDance, Moonshot and 01.ai have been steadily narrowing the gap with US peers, matching their capabilities and surpassing them in cost efficiency. DeepSeek-V3 embodies the success of this resourceful approach. According to its technical report, the model was trained using a data centre powered by Nvidia H800 GPUs — a less advanced chip than Nvidia’s latest releases. Despite this, DeepSeek completed training in just two months at a cost of $5.5mn — a fraction of the sums reportedly spent by US companies such as OpenAI. The inconvenient truth for US policymakers is that strict export controls have forced Chinese tech companies to become more self-reliant, spurring breakthroughs that might not have occurred otherwise.

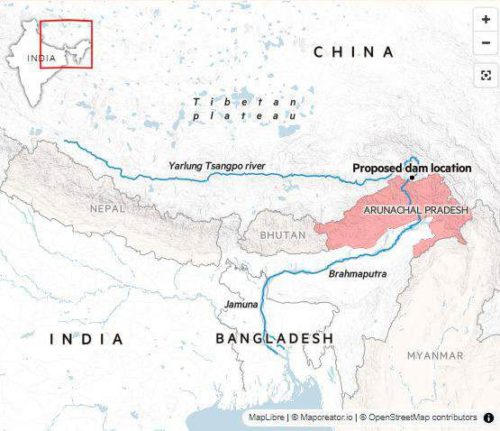

China – India: India has voiced concern about Beijing’s plan to build a dam in Tibet that is three times larger than China’s Three Gorges, currently the world’s largest hydropower facility. India fears that the dam, located in seismic Tibet, could spur floods and water scarcity downstream, while giving China the upper hand in any potential stand-off between the nuclear-armed neighbours. “It is a mega project with a lot of ecological disturbances and it does not take into account the interests of the lower riparian states,” said Randhir Jaiswal, spokesperson for India’s foreign ministry.

North Korea – US: North Korea conducted on Saturday (Jan 25) a strategic cruise missile test, state media KCNA reported on Sunday. The underwater-to-surface strategic cruise missiles travelled 1,500km and flew between 7,507 and 7,511 seconds before hitting their targets, KCNA reported. The military alliance and joint drills between South Korea and the US were to blame for the growing tensions in the region, the ministry said in a statement carried by KCNA.

Israel – Palestine: International mediators resolved disagreements over fragile ceasefires in Gaza and Lebanon late on Sunday, after clashes involving the Israeli military and civilians threatened to undermine both accords. Israeli Prime Minister Benjamin Netanyahu’s office announced Hamas would be releasing three hostages in Gaza on Thursday, including Arbel Yehud, resolving the first major crisis of the Gaza ceasefire agreement, which took effect one week ago. In return, Israel will allow displaced Palestinians in Gaza to return to their homes in the north of the shattered territory starting on Monday.

US – Israel – Lebanon: Trump’s administration announced that the ceasefire agreement between Israel and Lebanon, reached last November through American mediation, would be extended until February 18. With Israeli forces still holding territory inside Lebanon, hundreds of residents came under Israeli fire as they attempted to return on foot to their villages. According to Lebanon’s health ministry, 22 people were killed and 124 injured on Sunday.

Credit Treasuries

The US Treasury curve bear marginally steepened last week (only 4 trading sessions) with the 2years US Treasury yield rebounding by 4bps, 5yield gained 9bps, 10years yield was up 7bps, and the long bond yield was up by 4bps.

5years US IG credit spreads were unchanged during the week at 48bps, and 5years US HY credit spreads tightened by 5bps to finish the week at 297bps. In term of performances, both US IG & US HY gained about 35bps last week while US leverage loans gained 5bps.

FX

DXY USD Index fell 1.74% to close the week at 107.44, driven by the absence of broad and immediate tariff implementation from the new US administration.

However, President Trump suggested possible tariffs on Mexico/ Canada/China. Fears around potential tariffs on China seemingly ease last Friday amid Trump’s remarks that he would rather not have to use tariffs on China. On US macro data, Services PMI for January prelim missed expectation significantly (A: 52.8, C: 56.5), while UMich sentiment missed expectation as well (A: 73.2, C: 71.1).

European Currencies rose against USD, with EURUSD rising 2.18% to 1.0497 and GBPUSD rising 2.59% to 1.2484, driven by broad-based USD weakness. EUR was supported by strength in Eurozone PMIs data, exceeding expectation. UK PMI beats consensus, but underlying details are less optimistic with an employment index below 50, contraction in new orders, and signal of inflationary pressures. UK unemployment in line, up 0.1ppts to 4.4% in three months to November. Employment growth also close to expectations at 36k. Wages measures lean hawkish, however, with regular weekly earnings up 5.6%yoy, consensus at 5.5%.

USDJPY fell 0.19% to close the week at 156 despite broad USD weakness and BoJ raising interest rate. BoJ raised rates from 0.25% to 0.50% and revised up its inflation outlook. BoJ Governor Ueda strikes a balanced tone at the press conference reiterating the BoJ’s stance of raising rates if the Banks’ outlook is realized. On Japan Macro, Core CPI (ex-fresh food) rose to +3.0% y/y in December (C: 3.0%; P: 2.7%); Core-Core CPI (exfresh food and energy) remained unchanged at 2.4% y/y (C: 2.4%). Nominal wage growth was revised up to 3.7% y/y (Preliminary: 3.5%), while base salary for regular workers marginally revised down to 2.7% y/y (Preliminary: 2.8%).

USDCAD fell 0.94% to close the week at 1.434. Canada headline CPI missed, up 1.8% y/y in December (C: 1.9%). Core measures in line, 2.4% and 2.5% for median and trimmed mean respectively. Market is pricing 23bps of cuts in this week’s BOC meeting.

USDNOK fell 2.23% to close the week at 11.194. The Norges Bank maintained its policy rate at 4.50% at its January meeting as widely expected. However, the governor commented that “the policy rate will likely be reduced in March.” Market is pricing 24.3 bps cuts in its March meeting.

Oil & Commodities

Oil Futures fell last week, with WTI and Brent falling 4.13% and 2.83% to 74.66 and 78.50 respectively. The fall in oil prices came as President Trump revoked offshore oil and gas leasing bans that effectively blocked drilling in most US coastal waters. In addition, Trump asked OPEC to “bring down the cost of oil”. On the weekly report, the EIA reporting a 1.0mn barrel decrease in weekly US crude oil inventories.

Gold rose 2.49% to close the week at 2770.58, driven by broad based USD weakness. Immediate resistance level at 2800, while support level at 2700/2660.

Economic News This Week

-

Monday – CH PMI, US New Home Sales/ Dallas Fed Mfg Act,

-

Tuesday – AU Biz Confid., US Durable Goods Orders/ Cons. Confid./ Richmond Fed Mfg

-

Wednesday – AU CPI, SW Riksbank Rate Decision, US MBA Mortg. App./ Wholesale Inv., CA BoC Rate Decision, US FOMC Rate Decision

-

Thursday – NZ Trade Balance/ Biz Confid., UK Mortg. App., EU GDP/ Unemploy. Rate/ ECB Rate Decision, US GDP/ Personal Consumpt./ Initial Jobless Claims/ Pending Home Sales

-

Friday – JP Tokyo CPI/ Indust. Pdtn, AU PPI, EU ECB 3 Yr CPI Expectation, CA GDP, US Personal Income/ Personal Spending/ Core PCE Index

Sources – Various news outlets including Bloomberg, Reuters, Financial Times, FactSet, Associated Press

Disclaimer: The law allows us to give general advice or recommendations on the buying or selling of any investment product by various means (including the publication and dissemination to you, to other persons or to members of the public, of research papers and analytical reports). We do this strictly on the understanding that:

(i) All such advice or recommendations are for general information purposes only. Views and opinions contained herein are those of Bordier & Cie. Its contents may not be reproduced or redistributed. The user will be held fully liable for any unauthorised reproduction or circulation of any document herein, which may give rise to legal proceedings.

(ii) We have not taken into account your specific investment objectives, financial situation or particular needs when formulating such advice or recommendations; and

(iii) You would seek your own advice from a financial adviser regarding the specific suitability of such advice or recommendations, before you make a commitment to purchase or invest in any investment product. All information contained herein does not constitute any investment recommendation or legal or tax advice and is provided for information purposes only.

In line with the above, whenever we provide you with resources or materials or give you access to our resources or materials, then unless we say so explicitly, you must note that we are doing this for the sole purpose of enabling you to make your own investment decisions and for which you have the sole responsibility.

© 2020 Bordier Group and/or its affiliates.